(page TRG 10) sa150

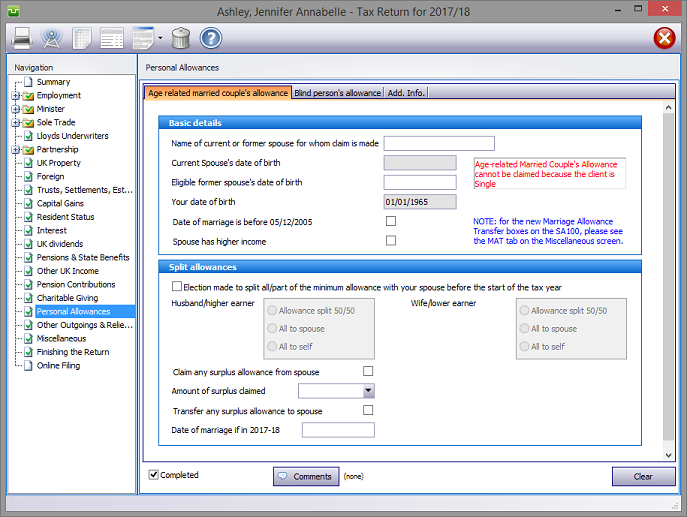

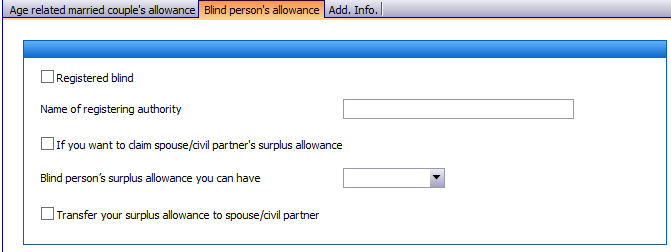

In the Navigation pane click on Personal Allowances and select the relevant tab.

Please read the HMRC document sa150.

Personal Allowances details

Age related married couple's allowance

Proceed by making the appropriate entries.

Proceed by making the appropriate entries.

Finishing

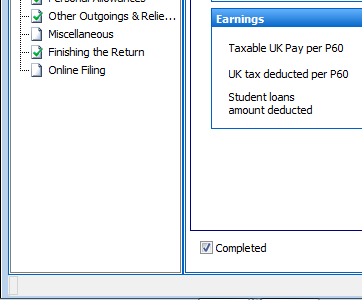

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

| Notes |

| sa150 |

| Page TRG-10 |

Copyright © 2025 Topup Software Limited All rights reserved.